By Matej Prša— Blockchain & Web3 Writer

As 2025 draws to a close, the crypto-asset industry exhibits a quieter, more focused maturity. The era of pure speculation has largely been replaced by a selection process favoring chains with clear utility, specific cultural capital, and sustainable economics. The Chiliz Chain is distinguishing itself in this new environment.

While its heritage as the issuer of Fan Tokens remains foundational, the technical and strategic developments of the last eighteen months have positioned Chiliz as more than just a token issuer, it is the dedicated digital infrastructure for global sports commerce.

The release of the definitive Whitepaper v1.0 in August 2025 and the subsequent Snake8 hard fork in October marked the completion of the core architecture. For developers, the proposition is simple, Chiliz offers the only ecosystem where the user base is already a fan base.

This analysis explores the compelling case for building on Chiliz as we enter 2026, focusing not on price, but on architectural readiness and the massive, untapped opportunity in Real-World Assets (RWA).

The Technical Reformation

To understand the opportunity of 2026, one must appreciate the engineering feats of 2024 and 2025. The journey began with the Dragon8 hard fork in mid-2024, a watershed moment that transitioned the network from a simple transactional layer into a robust, EVM-compatible powerhouse. But it was the refinement of this year, specifically the Snake8 upgrade in October 2025, that perfected the formula.

The Chiliz Chain now operates on a Proof of Staked Authority (PoSA) consensus mechanism. For the uninitiated developer, this might sound like just another acronym, but in the context of “SportFi” (Sports Finance), it is the only logical choice. General-purpose chains often sacrifice speed for theoretical decentralization, or security for speed. Chiliz has threaded the needle. By utilizing a set of active validators that includes some of the biggest sporting brands in existence, like Paris Saint-Germain and the K-League the chain achieves a unique form of “Proof of Reputation.”

These validators are not anonymous mining pools located in data centers in the Arctic, they are multi-billion-dollar public entities with reputations to protect. This provides a security guarantee that pure math cannot replicate. For a developer building a ticketing application or a high-stakes fantasy league, this stability is paramount. You are not building on a casino, you are building on a federation.

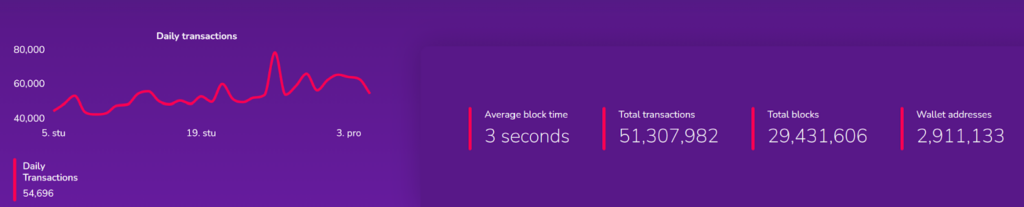

Furthermore, the chain’s 3-second block time and deterministic finality mean that the user experience (UX) friction that plagues other chains is non-existent here. When a fan scores a goal in a GameFi app, it registers instantly. When a bet is settled, it is settled now. In the attention economy of sports, latency is death. Chiliz Chain has engineered latency out of the equation.

Source: https://scan.chiliz.com/

The Economic Blueprint

The most significant friction point for developers in Web3 has always been economic alignment. On Ethereum, your success drives up gas fees, eventually pricing out your own users. On Solana, you fight for bandwidth against arbitrage bots. Chiliz, however, has curated an economic environment specifically designed for app sustainability, crystallized in the Tokenomics 2.0 model solidified by the August 2025 Whitepaper.

The introduction of EIP-1559 (the fee-burning mechanism) during the Dragon8 era has now had over a year to mature. The data is clear, the more the ecosystem is used, the scarcer $CHZ becomes. But for the builder, the real genius lies in the Inflation Decay Model.

Unlike chains that aggressively inflate supply to pay mercenary liquidity providers, Chiliz has committed to a predictable, decaying inflation schedule. Inflation started at 8.8% and is programmed to decay annually until it stabilizes at a “forever rate” of 1.88% after 14 years.

Why does this matter to a Python or Solidity engineer? Because it creates predictability.

When you build a business on the Chiliz Chain, you are building on a substrate where the monetary policy is not subject to the whims of a DAO panic-vote. It is mathematical and transparent. The 65% of inflation allocated to validators and delegators ensures the network remains secure, while the 25% allocated to Ecosystem & Operational Distribution creates a constant, renewable war chest for grants and builder incentives.

This is the “Oil Fund” of SportFi. The protocol is designed to pay you to build.

The $PEPPER Effect & Community Liquidity

No analysis of the 2025 landscape is complete without addressing $PEPPER.

$PEPPER introduced the chaos, the memes, and the high-velocity liquidity that attracts retail users. For a developer, $PEPPER is not a joke, it is a customer acquisition tool.

The massive airdrops to $CHZ holders created a captivated audience of wallet-active users who are looking for places to spend, stake, and yield-farm their tokens. Developers launching casual games, prediction markets, or NFT projects in late 2025 found that integrating $PEPPER as a payment or reward token instantly unlocked a user base of hundreds of thousands of “Pepper People.”

This symbiotic relationship, $CHZ as the serious infrastructure asset and $PEPPER as the high-velocity community token gives developers a dual-token economy out of the box. You don’t need to bootstrap your own liquidity, you just need to tap into theirs.

The Horizon: Tokenizing Team Ownership (RWA)

The single most significant vertical for developers is the movement toward Real-World Assets (RWA), driven by the strategic alliance between Chiliz and Assetera in late 2025. This partnership creates a compliant pathway for on-chain assets, especially within the context of European regulatory clarity (e.g., MiCA).

This focus directly leads to the ultimate frontier, Tokenizing Team Ownership.

- Ticket Scalping & Identity:

The Holy Grail of SportFi. By utilizing Chiliz Chain’s native NFT standards and identity proofs, a developer can build a ticketing platform where the ticket is a non-transferable (or conditionally transferable) token. The “secondary market” becomes a regulated smart contract where royalties go back to the club and the price ceiling is enforced by code, not police. The tech is there; it just needs a builder to package it. - Memorabilia Authentication:

The market for game-worn jerseys is rife with fraud. By linking physical NFC chips in jerseys to digital twins on Chiliz Chain (a concept pioneered by Chiliz but open for third-party expansion), developers can build the “eBay of Verified Sports Assets.” The provenance is immutable. The Assetera partnership ensures this can be done in a way that is compliant with EU regulations, a massive moat against competitors. - DeFi for Fans:

Standard DeFi (staking, lending) is boring. “FanFi” is emotional. Developers can build lending protocols where the collateral is not just ETH, but a basket of Fan Tokens. Imagine a prediction market where the liquidity pools are segmented by team allegiance, a “Manchester City vs. Inter Milan” liquidity pool where the APY fluctuates based on match results. This gamification of finance is only possible on a chain where the assets (Fan Tokens) already exist.

The “Open Stadium” Philosophy

For a long time, the criticism of Chiliz was that it was a “walled garden” everything happened on the Socios app. That era is emphatically over. The mantra of the Whitepaper v1.0 is Openness.

The integration of Paribu Net and the expansion of Chiliz Labs demonstrates a pivot to a permissionless architecture. The stadium is no longer just for the internal team, it is open for anyone to rent a booth.

The Chiliz Graph, the robust RPC endpoints provided by Ankr, and the full EVM equivalence mean that an Ethereum developer needs to learn nothing new to deploy on Chiliz. If you can write Solidity, you are a Chiliz developer, and you are pitching directly to sports fans.

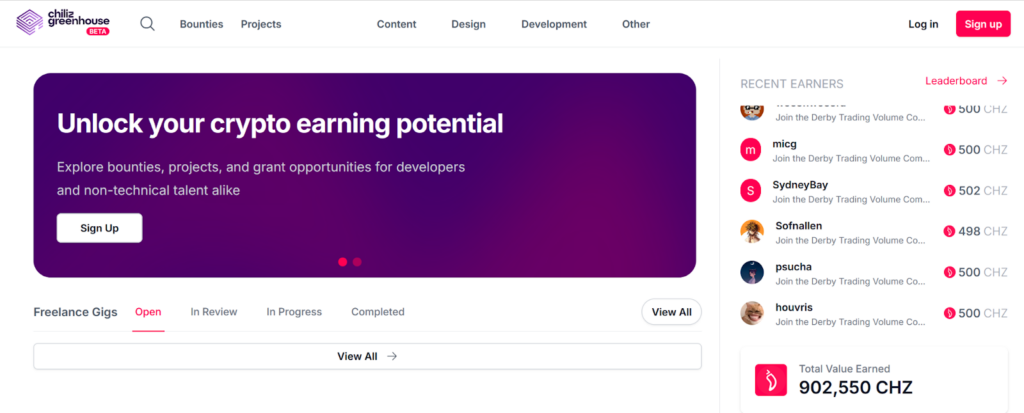

The Greenhouse initiative and the hackathons scheduled for early 2026 are putting capital behind this philosophy. The chain is actively seeking developers to build:

- AI-driven sports analytics stored on-chain.

- Decentralized fantasy leagues (DFS) with automated payouts.

- Social betting apps that leverage the “Social Graph” of fan token holders.

Source: https://greenhouse.chiliz.com/

The Bullish Case for 2026

As we stand in December 2025, the macro trends are converging perfectly for Chiliz.

- Crypto Regulation is Clarifying. With frameworks like MiCA fully operational in Europe, the Chiliz approach (regulated, partner-heavy, compliant) is winning. Anarchic chains are facing legal headwinds, Chiliz, with its “big brand” validators, is viewed as the safe harbor for enterprise capital.

- The Experience Economy. The world is moving away from “buying stuff” to “buying experiences.” SportFi is the financialization of experience.

- The Tech Stack is Ready. The “Dragon8” and “Snake8” upgrades have removed the technical debt. The chain is fast, cheap, and scalable.

The bullish case is simple: Sports is the only vertical in crypto with inherent viral loyalty.

Nobody is “loyal” to a decentralized exchange in the way they are loyal to FC Barcelona. By building on Chiliz, developers inherit that loyalty. You are not acquiring users; you are inheriting fans.

Analysis of the “Bullish” Narrative for Developers

To further substantiate why this is the optimal time for developers, we must look deeper into the “Moat of IP.” In software development, a “moat” is a competitive advantage that is difficult to copy. Most blockchains have zero moats, you can fork the code of Ethereum or Solana in an afternoon.

You cannot “fork” the partnership with the Premier League clubs. This IP Moat is what protects the developer. If you build a fantasy game on Chiliz, you are building inside a fortress protected by the world’s biggest brands. If you build it on a generic chain, you are exposed to the elements.

The October 2025 “Snake8” hard fork was a subtle but critical signal to the dev community. By optimizing the validator reward distribution logic, the governance showed it is willing to iterate fast to ensure fairness. It moved the chain away from a “winner takes all” validator model to a more egalitarian distribution, encouraging smaller infrastructure providers to join the network. This decentralization of infrastructure reduces the risk of centralization vectors, a common worry for hardcore crypto developers.

We cannot overstate the importance of the $PEPPER token (the community “meme” token) as a developer tool. In 2025, “Point Systems” became the meta for user retention. However, off-chain points are boring. $PEPPER serves as an on-chain, liquid “point system” that any developer can plug into.

- Scenario. You launch a new prediction dApp.

- Problem. You have no token and no money for rewards.

- Solution. You treat $PEPPER (which your users already hold) as the currency of your app. You instantly have a “GameFi” economy on Day 1 without minting a single token of your own.

Looking ahead, the roadmap suggests a heavy focus on account abstraction (ERC-4337). This will allow developers to build apps where the user doesn’t even know they are using crypto, no gas fees (sponsored by the dev), no seed phrases, just social login. For sports fans, who are often non-technical, this is the holy grail. Chiliz is aggressively implementing these standards to ensure the “Next Billion Users” can actually use the apps you build.

In conclusion, the table is set. The Chiliz Chain of late 2025 is a refined, highly specific, and economically potent environment. For the developer who wants to build products that real people, not just crypto traders, will actually use, there is no second best.

Conclusion: Pick Up The Ball

The Chiliz Chain of December 2025 is a chain built not for general purpose computing, but for a specific, high-passion, high-volume purpose, Sports and Entertainment.

For the developer reading this: The infrastructure risk is gone. The liquidity is there. The brands are there. The users are waiting.

2026 will not be the year of the “Protocol Layer”; it will be the year of the “Application Layer.” The next Unicorn of crypto will not be another L2 rollup; it will be the app that lets a fan in Tokyo instantly buy a fraction of a goal-scoring ball from a match in Munich, trade it for a VIP ticket, and stake the remainder for yield.

That application can only be built on one chain.

The stadium is open. The crowd is roaring. It’s time to build.