By Matej Prša – Blockchain & Web3 Writer

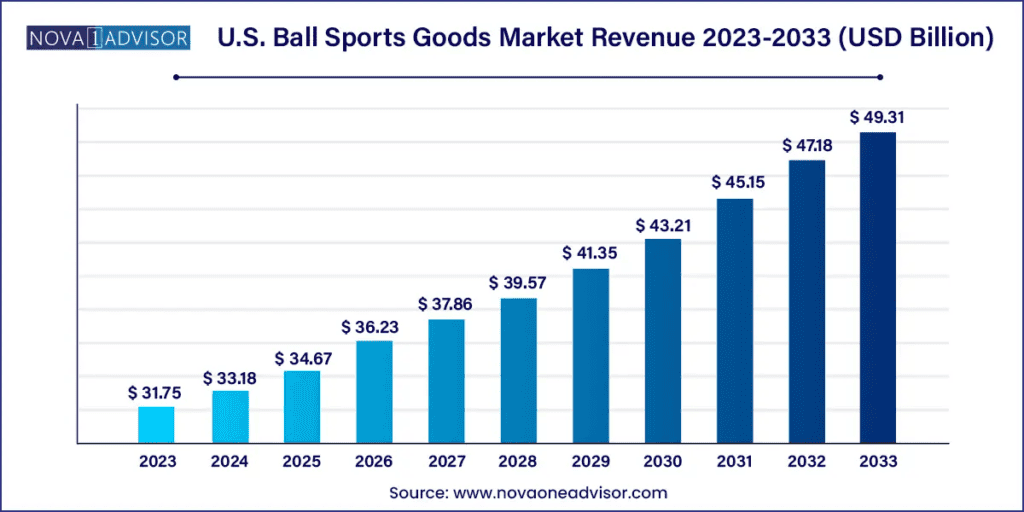

For the better part of a century, the global sports economy has functioned as a unidirectional value stream, a model that, while profitable, has remained fundamentally extractive. Fans, the undeniable lifeblood of the industry, have existed merely as peripheral consumers. They subscribe to increasingly fragmented broadcast packages, purchase apparel, and pay premiums for match-day experiences. Yet, despite being the primary source of revenue and the sole source of emotional equity, the financial equity of these sporting giants has remained locked behind the iron gates of private equity syndicates, sovereign wealth funds, and high net worth individuals.

Source: Novaoneadvisor

However, the tectonic plates of sports finance are shifting. We are currently witnessing the Great Unlocking. The convergence of Real World Asset (RWA) tokenization and decentralized finance (DeFi) is dismantling the barriers that have historically separated passion from profit. By migrating sports related assets onto the Chiliz Chain, we are not merely introducing a new engagement layer, we are re-engineering the financial DNA of the world’s most resilient industry.

This transition represents a paradigm shift from a Consumption Model to a Stakeholder Model. In this new era, the intrinsic value of sports, defined by its recession-proof predictability, its unmatched global scale, and its cultural primacy is being fractionalized, digitized, and made liquid for the first time in history. We are moving toward a future where the fan is no longer just a spectator, but a sovereign participant in the economic upside of the teams and athletes they support.

The Technical Superiority of Chiliz Chain

To facilitate a migration of assets valued in the trillions, the underlying ledger must be more than just a database. It must be a fortress of digital trust. It requires three non-negotiable traits: absolute security, high-frequency scalability, and rigorous regulatory compatibility. The Chiliz Whitepaper articulates a vision for the Chiliz Chain as a purpose-built Layer-1 solution, engineered to transcend the limitations of early-generation generalist blockchains.

1. The PoSA Consensus and Institutional Trust

At the core of this infrastructure lies the Proof-of-Staked-Authority (PoSA) consensus mechanism. In the dilemma of blockchain architecture (Security vs. Scalability vs. Decentralization), PoSA represents the optimal middle ground for enterprise-grade RWAs.

Unlike Proof-of-Work, which is energy intensive and slow, or pure Delegated Proof-of-Stake, which can suffer from plutocratic centralization, PoSA relies on a curated set of reputable validators. These validators are not anonymous entities, they are known stakeholders within the ecosystem who stake substantial capital (CHZ) to secure the network. This hybrid model allows the Chiliz Chain to achieve deterministic finality with a block time of approximately 3 seconds.

For the sports market, this speed is not a luxury, it is a necessity. Secondary markets for sports assets function like high-frequency trading desks, price discovery happens in real-time during live matches. A blockchain that takes minutes to confirm a transaction cannot support the volatility of a live penalty kick. PoSA ensures that the infrastructure moves as fast as the game itself.

2. EVM Compatibility and Modular Interoperability

The Chiliz Chain’s full compatibility with the Ethereum Virtual Machine (EVM) is a strategic masterstroke. It ensures that the ecosystem does not exist in a silo. Any RWA minted on the network can leverage the vast, existing suite of Ethereum-based development tools, wallets (like MetaMask), and audited smart contract standards.

Specifically, the adoption of standards such as ERC-3643 (the standard for permissioned tokens) allows for identity-gated ownership. This is crucial for compliance, ensuring that a tokenized share of a football club is only held by users who have passed KYC (Know Your Customer) checks. Furthermore, this interoperability unlocks composability. A tokenized share of a stadium (an RWA) could theoretically be used as collateral in a decentralized lending protocol (DeFi) on the Chiliz Chain to borrow stablecoins. This bridges the gap between on-chain liquidity and off-chain asset value, creating a unified financial ecosystem.

The Four Pillars of Sports RWA Tokenization

The Trillion-Dollar thesis is not predicated on a single asset class, but rather on a diverse portfolio of sports related instruments. Currently, these assets are trapped in illiquid, private markets, making them inefficient. Tokenization liberates them across four primary pillars.

Pillar 1: Fractionalized Equity and the Liquidity Premium

Traditional sports ownership is plagued by the Liquidity Trap. An investor holding a 5% limited partnership stake in a top-flight Premier League club faces immense friction when attempting to divest. The pool of potential buyers is small, the legal costs are high, and the process can take months.

Tokenization solves this by introducing the Liquidity Premium, the tangible increase in an asset’s value that occurs simply because it is easier to trade. On the Chiliz Chain, a $100 million equity stake can be fractionalized into millions of tokens. This democratizes access, allowing a retail investor in Tokyo to buy $50 worth of a Spanish team, while simultaneously allowing the club to raise capital without a single controlling owner dictating terms. Deep research into private equity markets suggests that tokenizing these illiquid assets can unlock a 20% to 30% valuation uplift, purely by removing the barriers to entry and exit and allowing for 24/7 global price discovery.

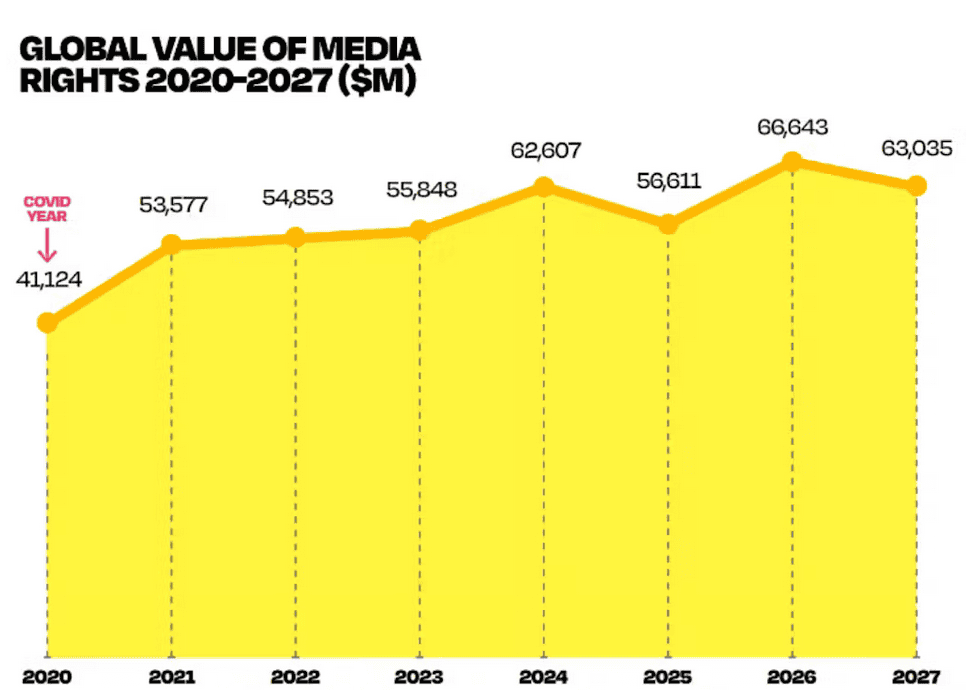

Pillar 2: The Tokenization of Media and Broadcast Rights

Media rights are the crown jewels of sports finance. In 2024, the aggregate value of global broadcast contracts exceeded $60 billion. However, for the leagues, these are lumpy assets, cash comes in large, infrequent tranches over long periods.

Source: SportBusiness Global Media Report 2024

Through Chiliz-based smart contracts, these future cash flows can be securitized into Yield-Bearing Tokens.

- The Mechanism. A league can issue a Broadcast Revenue Token (BRT). The smart contract is programmed to automatically distribute a percentage of the broadcast income to token holders the moment the funds hit the league’s wallet.

- The Benefit. This functions as a Sports Bond. Leagues receive immediate, upfront capital for stadium renovations or expansion fees. Investors, in turn, gain access to an asset class that is uncorrelated with the S&P 500. Whether the stock market crashes or surges, the broadcast contract is legally binding, providing a predictable, fixed-income yield.

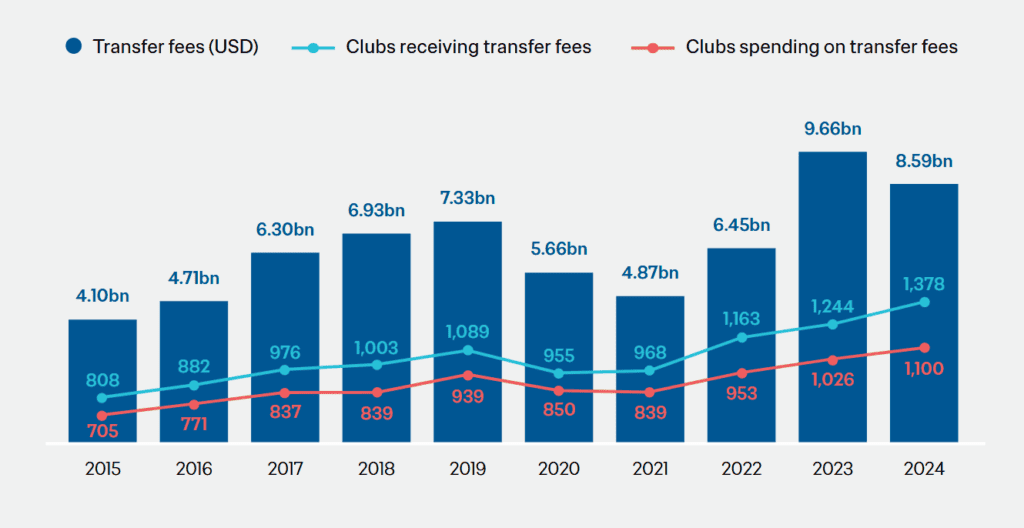

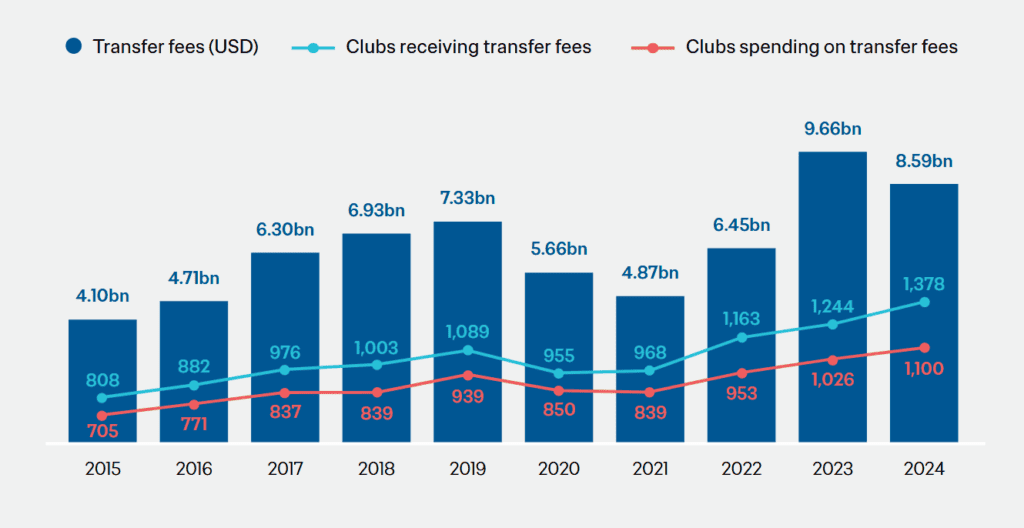

Pillar 3: Athlete Intellectual Property and Transfer Market Futures

The athlete transfer market is perhaps the most unique financial ecosystem on earth. Every year, billions of dollars change hands as players move between clubs, yet this value is often speculative and centralized. In a SportFi future, we move toward the tokenization of Human Capital Derivatives.

Source: FIFA, Website

Imagine a system where a young athlete’s future transfer value or image rights are tokenized via a DAO (Decentralized Autonomous Organization) on the Chiliz Chain. Fans and investors can fund the athlete’s early career development, paying for nutrition, coaching, and travel in exchange for a small percentage of their future earnings or transfer fees. This transforms Social Capital (hype) into Financial Capital (funding). For the athlete, it creates a debt-free runway to success, for the investor, it creates an index of the next generation of talent. This is all governed by immutable smart contracts that execute payouts automatically upon a transfer, eliminating the need for predatory intermediaries.

Pillar 4: Infrastructure and Real Estate Tokenization

Stadiums are massive, capital-intensive real estate assets that are notoriously inefficient, often sitting empty for 300 days a year. Tokenizing stadium ownership or creating digital Perpetual Seat Licenses (PSLs) allows clubs to crowdsource funding for new developments.

Instead of relying on taxpayer subsidies or high-interest bank loans, clubs can offer fans a fractional share of the stadium’s revenue streams. A Stadium Token holder might receive dividends not just from match tickets, but from every beer sold, every concert hosted, and every corporate event booked. This aligns the incentives of the fan and the club, the more the stadium is utilized, the more the fan earns, turning the supporter base into an active marketing force for the venue.

Economic Engineering: Dragon 8 and the Scarcity Engine

For a blockchain network to host trillions of dollars in asset value, its native currency must have a robust, sustainable, and predictable economic model. The Dragon 8 upgrade to the Chiliz ecosystem was a pivotal moment, introducing a sophisticated tokenomics structure designed for multi-decade longevity.

Controlled Inflation and Security Budget

The system starts with an annual inflation rate of 8.80%, which follows a decaying curve year-over-year. This inflation is not a bug, it is a feature. It serves as the security budget of the network, ensuring that validators are permanently incentivized to maintain their hardware and honest behavior. Without this reward layer, the security of the trillion-dollar assets on-chain would be at risk.

The Fee Burn: The EIP-1559 Effect

Crucially, Chiliz has implemented a transaction fee burning mechanism, similar to Ethereum’s EIP-1559. This acts as the ecosystem’s Scarcity Engine. Every time a user trades a Fan Token, mints an RWA, or transfers a media rights asset, a portion of the gas fee (paid in $CHZ) is permanently destroyed.

This creates a direct correlation between the utility of the network and the scarcity of the token. As the SportFi ecosystem grows, as more stadiums are tokenized and more transfers are processed, the supply of CHZ is continuously suppressed. In a high-velocity market, this burning mechanism can offset the inflation, potentially making the protocol deflationary and increasing the unit value for all holders.

Governance and Staking

Finally, CHZ holders are elevated from spectators to governors. Through the staking dashboard, holders can delegate their tokens to validators, effectively voting on the future of the protocol. They decide which assets are whitelisted for tokenization and which technical upgrades are implemented. This ensures a community-led quality control mechanism, preventing the chain from being flooded with low-quality assets and maintaining the prestige of the Chiliz RWA ecosystem.

Regulatory Compliance as a Competitive Moat

In the world of institutional finance, regulation is not an obstacle, it is a prerequisite. One cannot discuss the mass adoption of RWAs without addressing the legal frameworks that govern them. The Chiliz Whitepaper distinguishes itself through a rigorous commitment to legal clarity, specifically aligning with the European Union’s Markets in Crypto-Assets (MiCA) Regulation.

By adhering to MiCA standards, Chiliz provides a level of institutional safe harbor that is rare in the crypto space. Many blockchains operate in a regulatory grey zone, making them non-investable for pension funds, insurance companies, and family offices that have strict compliance mandates.

Chiliz’s focus on transparency, detailed in Part J of the Whitepaper regarding sustainability reporting and clear issuer accountability creates a bridge for Traditional Finance (TradFi). When a Premier League club or a Formula 1 team decides to tokenize, they cannot risk legal ambiguity. They require a chain that speaks the language of regulators. Chiliz’s compliance-first architecture acts as a competitive moat, positioning it as the primary destination for the clean, compliant capital that defines the institutional sports world.

The Path to $1 Trillion

The road to a trillion-dollar valuation for sports RWAs is a marathon, not a sprint. We can project this evolution occurring in three distinct, overlapping phases:

- Phase I: The Engagement Era (2019-2024). This phase proved the concept. The successful rollout of Fan Tokens demonstrated that millions of global users are willing to hold digital assets related to their favorite teams. It established the user base, the wallet infrastructure, and the initial emotional connection to digital ownership.

- Phase II: The Infrastructure Era (2025-2027). This is our current trajectory. The migration to the Chiliz Chain, the implementation of Dragon 8, and the launch of the first Pilot RWAs. We will likely see the first fractionalized stadium ownership deals and minor-league equity tokens during this period, testing the legal and technical rails.

- Phase III: The Institutional Era (2028 and beyond). The maturity phase. This will witness the full-scale tokenization of top-tier media rights and the entry of global investment banks acting as liquidity providers. We will see the emergence of complex financial derivatives, such as shorting a team’s performance or hedging against player injuries, built on top of the Chiliz RWA layer.

Source: Gemini

Risks, Mitigation and Systemic Resilience

Honesty is paramount in financial innovation. As outlined in Part I: Risks of the Chiliz Whitepaper, the journey is not without peril. The ecosystem faces technical risks (smart contract vulnerabilities), market risks (volatility of underlying assets), and the ever-shifting sands of global jurisdictional law.

However, the Chiliz Chain mitigates these systemic risks through its Decentralized Staked Authority. Unlike a centralized database managed by a single ticketing firm or bank, the distributed nature of the Chiliz validators ensures that the record of ownership for these assets is immutable and resistant to single points of failure.

Furthermore, deep research suggests that sports RWAs may actually serve as a powerful macro-hedge. The value of a football team’s broadcast rights or a stadium’s yield is often locked in for 5–10 years. These revenue streams do not correlate directly with the price of tech stocks, the rate of inflation, or the fluctuations of fiat currency. In a turbulent global economy, the stability of sports revenues makes them a highly attractive safe haven asset for diversified portfolios.

Conclusion: The Sovereign Fan and the Future of SportFi

The RWA Frontier is more than just a technological milestone or a new financial instrument, it is a fundamental democratization of power. For the first time in the history of organized sport, the economic value generated by the sweat of athletes and the unyielding passion of fans will be accessible to everyone, not just the elite few in the owner’s box.

By leveraging the Chiliz Chain, a platform that is EVM-compatible, PoSA-secured, and MiCA-compliant, the sports industry is finally ready to claim its place as a premier global asset class. We are moving toward a future where owning your team is as simple as following them on social media. The barriers of geography, wealth, and access are crumbling.

As we look toward the trillion-dollar horizon, it is clear that the fusion of sports and blockchain is the most significant financial evolution in the history of the game. The stadium of the future isn’t just made of concrete and steel; it is constructed from code, community, and capital. Welcome to the era of SportFi.