Chiliz Manifesto

2026-2030

Unlocking the $1Trillion Sports Economy Through SportFi as The Chiliz Group moves from Fan Engagement to Core Financial Infrastructure.

Eight years in. Just getting started.

In 2018, we proposed a radical idea: that fans deserved more than passive consumption. That blockchain could bridge the gap between clubs and their global communities. That a new digital asset could bring utility and value to holders, whilst also, and this is a dirty word in sports so stay with us, monetize global fan bases by providing a new revenue stream for global clubs.

Fan Tokens are the most successful digital asset class in sports. Offering utility, ownership, and belonging to crypto-loving sports fans, whilst also growing into a new liquid and globally traded digital asset class.

The 3 Pillars of Chiliz 2030

Pillar 1 – Fan Tokens

The next stage will empower fans to become active participants in the ownership economy. by giving clubs new tools to unlock capital from global markets and building the framework to make tokenized sports assets as liquid, transparent and accessible as any asset on Wall Street.

Growing distribution: more chains, more liquidity, more token holders

- Omni-chain: in Q1 Fan Tokens will be available on other blockchains, starting with the leading high velocity chains. This increases the distribution and availability of Fan Tokens, expands liquidity and unlocks further DeFi opportunities.

Growing the asset class: more Fan Tokens, first US Fan Tokens

- US Fan Tokens: 2026 will see our re-entry into the US market, supported by greater clarity and growing demand for digital assets. The first US partnership will be announced in Q1.

- New National Team Tokens: This summer, look out for the launch of national team Fan Tokens on Socios.com as the locker room campaign comes to fruition, bringing a new wave of fans into the ecosystem ahead of a summer of football (or maybe this year we should say soccer?).

Growing the appeal of Fan Tokens: Linking tokenomics to what happens on the pitch

- Gamified tokenomics: If the team wins, the tokens burn, if they lose, more are minted. Tokenomics based on live match outcomes via smart contracts makes the market feel more like sport itself: competitive, seasonal and transparent.

Pillar 2 – Chiliz Chain

General-purpose chains compete on volume. We compete on purpose. Chiliz Chain will become the foundational settlement layer for sports finance. A purpose-built, institutional-grade ledger optimized for high-frequency tokenized IP trading. This includes Fan Tokens as collateral for advanced instruments, and native staking, lending, and liquidity protocols.

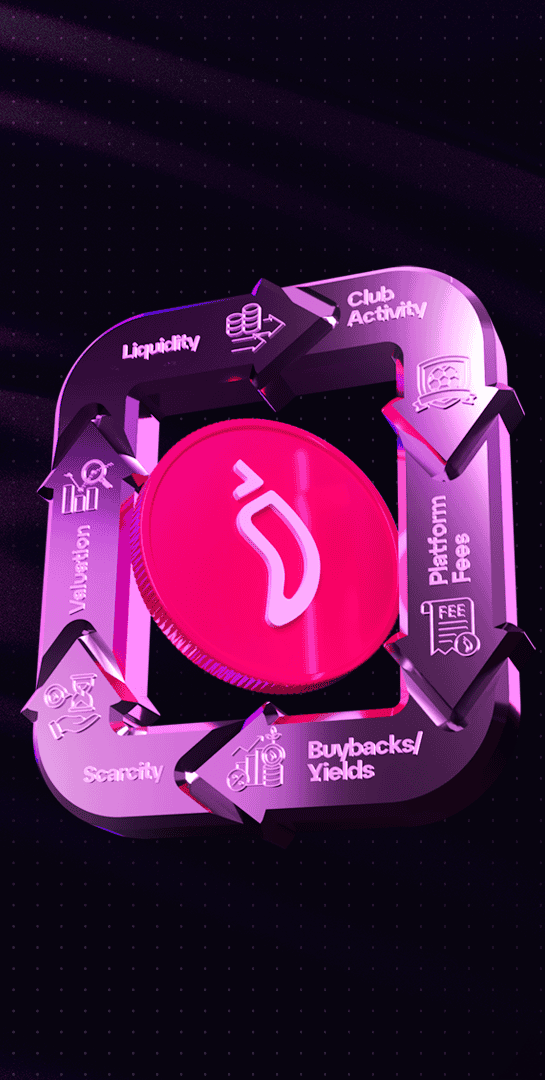

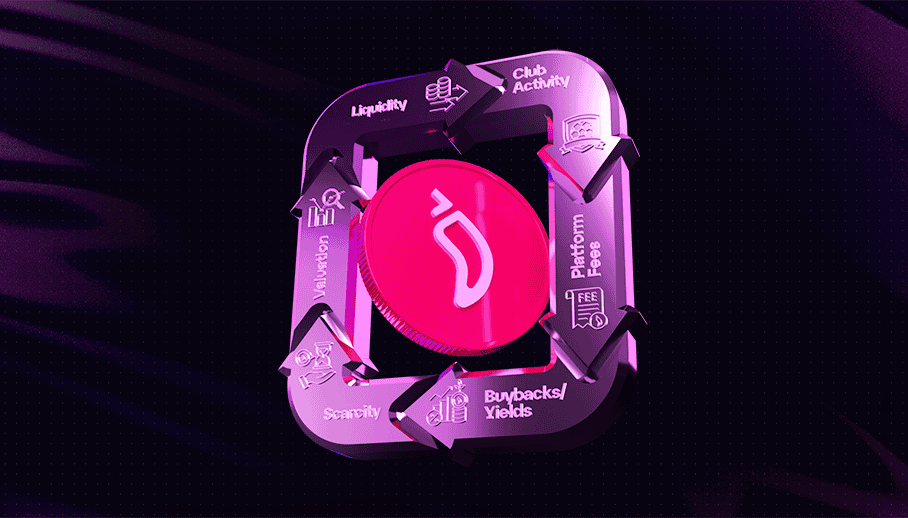

A virtuous cycle: As Fan Tokens succeed, the chain strengthens

- 10% of Fan Token Revenue to $CHZ buybacks: 10% of all Fan Token revenues generated ecosystem-wide will be earmarked for perpetual $CHZ buy-backs. This creates a virtuous flywheel where club activity generates fees, which fund buybacks and yield, creating scarcity that drives valuation and liquidity.

Native DeFi Infrastructure: Hosting advanced DeFi sports assets, including prediction markets, staking, and lending protocols.

- A key pillar is Chiliz Chain community DeFi provider Kayen, which provides decentralized exchange functionality, lending protocols and liquidity tools purpose-built for sports assets. With community token $PEPPER positioned as the governance token for Kayen, a decentralized ecosystem is being created where the community has a voice and a stake in protocol development and fees.

Socios.com: A DeFi wallet that is the home of utility for Fan Tokens & connects the ecosystem

- Socios.com 2030: The home of rewards and utility but also transitioning into a full SportFi hub: with live mint/burn tracking on match days, integrated DeFi wallet functionality, and native access to match-day predictions, performance staking and real-time leaderboards.

PILLAR 3 – Sports RWA & New Fan Token

By 2030 it is estimated that more than $16 trillion of RWAs will be tokenized on-chain.

By transforming illiquid assets into digital tokens, we enable fractional ownership, unlock immediate liquidity and automate complex cash flows. Chiliz Chain is uniquely engineered to provide the institutional-grade infrastructure required to turn the locked value of sports franchises into liquid, global digital assets and new revenue streams.

Bridging utility and equity: RWA Fan Tokens

Our long-term ambition is to combine Real World Assets with Fan Tokens, creating a new asset class that bridges utility and equity. Through minority stakes in clubs, token holders could gain financial exposure to team success, with a share of club revenue earmarked for buyback and burn, while retaining full utility features. Fan Token evolution unfolds in three stages. Stage one is utility: voting, rewards, access and engagement. Stage two is the tokenomics upgrade: gamified mechanics, performance-linked supply and transparent rules. Stage three introduces Fan Tokens that combine utility with real-world asset exposure. These stages stack: existing Fan Tokens retain full utility while gaining financial depth.

Pillar 1 – Fan Tokens

The next stage will empower fans to become active participants in the ownership economy. by giving clubs new tools to unlock capital from global markets and building the framework to make tokenized sports assets as liquid, transparent and accessible as any asset on Wall Street.

Growing distribution: more chains, more liquidity, more token holders

- Omni-chain: in Q1 Fan Tokens will be available on other blockchains, starting with the leading high velocity chains. This increases the distribution and availability of Fan Tokens, expands liquidity and unlocks further DeFi opportunities.

Growing the asset class: more Fan Tokens, first US Fan Tokens

- US Fan Tokens: 2026 will see our re-entry into the US market, supported by greater clarity and growing demand for digital assets. The first US partnership will be announced in Q1.

- New National Team Tokens: This summer, look out for the launch of national team Fan Tokens on Socios.com as the locker room campaign comes to fruition, bringing a new wave of fans into the ecosystem ahead of a summer of football (or maybe this year we should say soccer?).

Growing the appeal of Fan Tokens: Linking tokenomics to what happens on the pitch

- Gamified tokenomics: If the team wins, the tokens burn, if they lose, more are minted. Tokenomics based on live match outcomes via smart contracts makes the market feel more like sport itself: competitive, seasonal and transparent.

Pillar 2 – Chiliz Chain

General-purpose chains compete on volume. We compete on purpose. Chiliz Chain will become the foundational settlement layer for sports finance. A purpose-built, institutional-grade ledger optimized for high-frequency tokenized IP trading. This includes Fan Tokens as collateral for advanced instruments, and native staking, lending, and liquidity protocols.

A virtuous cycle: As Fan Tokens succeed, the chain strengthens

- 10% of Fan Token Revenue to $CHZ buybacks: 10% of all Fan Token revenues generated ecosystem-wide will be earmarked for perpetual $CHZ buy-backs. This creates a virtuous flywheel where club activity generates fees, which fund buybacks and yield, creating scarcity that drives valuation and liquidity.

Native DeFi Infrastructure: Hosting advanced DeFi sports assets, including prediction markets, staking, and lending protocols.

- A key pillar is Chiliz Chain community DeFi provider Kayen, which provides decentralized exchange functionality, lending protocols and liquidity tools purpose-built for sports assets. With community token $PEPPER positioned as the governance token for Kayen, a decentralized ecosystem is being created where the community has a voice and a stake in protocol development and fees.

Socios.com: A DeFi wallet that is the home of utility for Fan Tokens & connects the ecosystem

- Socios.com 2030: The home of rewards and utility but also transitioning into a full SportFi hub: with live mint/burn tracking on match days, integrated DeFi wallet functionality, and native access to match-day predictions, performance staking and real-time leaderboards.

PILLAR 3 – Sports RWA & New Fan Token

By 2030 it is estimated that more than $16 trillion of RWAs will be tokenized on-chain.

By transforming illiquid assets into digital tokens, we enable fractional ownership, unlock immediate liquidity and automate complex cash flows. Chiliz Chain is uniquely engineered to provide the institutional-grade infrastructure required to turn the locked value of sports franchises into liquid, global digital assets and new revenue streams.

Bridging utility and equity: RWA Fan Tokens

Our long-term ambition is to combine Real World Assets with Fan Tokens, creating a new asset class that bridges utility and equity. Through minority stakes in clubs, token holders could gain financial exposure to team success, with a share of club revenue earmarked for buyback and burn, while retaining full utility features. Fan Token evolution unfolds in three stages. Stage one is utility: voting, rewards, access and engagement. Stage two is the tokenomics upgrade: gamified mechanics, performance-linked supply and transparent rules. Stage three introduces Fan Tokens that combine utility with real-world asset exposure. These stages stack: existing Fan Tokens retain full utility while gaining financial depth.

The Vision 2030 Deployment Map

Turning vision into verifiable execution. Defining the milestones for a trillion-dollar asset class. From SportFi breakouts to regulated digital ownership, this is the blueprint for the future of Chiliz.

Laying the SportFi Foundation

Fan Tokens go multi-chain, DeFi infrastructure expands, tokenomics evolve, and RWA digital assets arrive.

- Q1: Liquidity and distribution

- Q2: Economic upgrades

- Q3: Fan Tokens gamified era

- Q4: Fan Tokens & RWAs

The SportFi Breakout

Fan Tokens expand beyond engagement, layering liquidity and financial depth on top of proven utility.

Expanding Digital Ownership

Regulated frameworks and institutional capital accelerate adoption of tokenized sports assets.

Utility Meets Equity

RWA-backed Fan Tokens combine governance, rewards and revenue participation.

Regulated, Liquid, Global

An era complete: passion, capital and ownership converge into a unified digital economy.

2026 Strategy: From Framework to Execution

A granular view of the Chiliz Group 2026 roadmap. Follow each strategic milestone in real-time as we deploy the infrastructure for a regulated, institutional-grade SportFi ecosystem.

Market Penetration & Capital Access

- Strategic US Re-entry: Deploying a compliant framework for US market expansion.

- Omni-Chain Interoperability: Breaking ecosystem silos via LayerZero to enable Fan Token liquidity on global external chains.

Tokenomics & Protocol Sustainability

- Deflationary Mechanisms: Activation of the perpetual $CHZ buy-back program to align protocol value with ecosystem growth.

- Socios.com V3: Institutional-grade DeFi wallet integration, bridging retail engagement with sophisticated on-chain finance.

Gamified Tokenomics

- Revenue-Share Primitives: Pioneering the first yield-bearing digital assets backed by professional sports revenue streams.

- Institutional On-ramps: Opening the rails for Wall Street capital to flow directly into team treasuries via tokenized equity.

Real-World Asset (RWA) Integration

- Revenue-Share Primitives: Pioneering the first yield-bearing digital assets backed by professional sports revenue streams.

- Institutional On-ramps: Opening the rails for Wall Street capital to flow directly into team treasuries via tokenized equity.

The Chiliz 2030 SportFi Mandate

CEO Alexandre Dreyfus outlines the roadmap for institutional RWA integration, US market expansion, and the evolution of programmable sports assets.