Chiliz Chain powers the first RWA protocol focused on football broadcasting financial operations

The intersection of blockchain technology and sports continues to unlock new possibilities. Today marks a significant milestone in that journey as Chiliz Chain welcomes Decentral, the first Real-World Asset (RWA) protocol designed specifically to provide liquidity for financing football media rights operations.

This launch represents a fundamental reimagining of how football clubs can access liquidity, demonstrating the practical power of blockchain infrastructure to solve real financial challenges in the sports industry.

The liquidity challenge football clubs face

Football clubs worldwide hold some of the most valuable assets in sports: media rights. These rights represent billions of dollars in future revenue. However, there’s a fundamental timing problem: clubs receive these payments over extended periods, while they need capital today to invest in players, facilities, and operations.

Traditionally, clubs have turned to banks and financial intermediaries to anticipate these receivables, often paying substantial fees and interest rates for the privilege. Recent examples, from FC Barcelona’s agreements with major financial institutions to the balance sheets of Brazilian clubs, demonstrate this is a multi-billion dollar market practice with significant room for improvement.

A decentralised solution built on Chiliz Chain

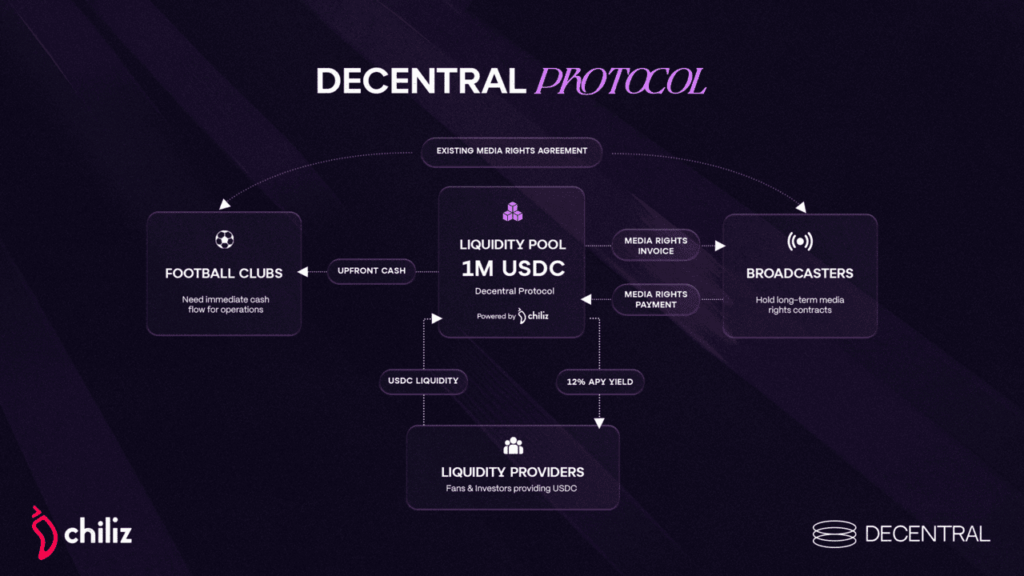

This is where innovation meets opportunity. The Decentral protocol, developed by an independent team within the SportFi ecosystem, leverages liquidity to advance receivables from broadcast rights, sponsorships, and other deals, allowing global investors to get exposure to real world assets from sports industry.

By building on Chiliz Chain’s infrastructure, Decentral enables the DeFi market to provide liquidity to clubs more efficiently and cost-effectively than traditional financial intermediaries. The protocol creates a permissionless, decentralised marketplace where capital can flow directly to where it’s needed most.

The initial liquidity pool at launch is valued at $1 million USD in USDC, offering a 12% APY with a 90-day locking period. This represents just the beginning of what’s possible when blockchain infrastructure meets real-world sports finance.

What this means for the sports industry

This launch sends a clear signal to club CFOs and sports executives: blockchain technology is building B2B solutions for your real financial pain points. The days of paying exorbitant fees to traditional intermediaries for liquidity may be coming to an end.

For the broader crypto and DeFi communities, Decentral proves the RWA thesis with one of the world’s most valuable and resilient asset classes: football media rights. It demonstrates that blockchain can ‘on-chain’ real economic value and create new efficiencies in established markets.

For developers and liquidity providers, this launch highlights that Chiliz Chain is actively building the future of sports finance. The infrastructure is here, proven, and ready for innovation.

Understanding the ecosystem

It’s important to understand the role each participant plays in this ecosystem:

- Chiliz Chain provides the technological infrastructure: the neutral, secure blockchain foundation that enables innovation. We are the platform that makes protocols like Decentral possible.

- Decentral operates as an independent, permissionless protocol built by a dedicated team within the SportFi ecosystem. They manage the protocol, its governance, and its operations.

This separation ensures that innovation can flourish while maintaining the integrity and neutrality of the underlying blockchain infrastructure. Chiliz celebrates and supports the innovations that builders bring to our platform, but each protocol operates independently.

Join us in building the future

The launch of Decentral marks a pivotal moment for SportFi. It proves that blockchain technology can deliver real value to traditional sports businesses while opening new opportunities for global capital to participate in the sports economy.

For developers considering where to build sports finance applications, the message is clear: Chiliz Chain offers the infrastructure, ecosystem, and vision to turn innovative ideas into reality.

This post is for informational purposes only. Returns are not guaranteed and past-performance are not indicative. Your capital is exposed to counterparty credit risk, smart-contract risk, and liquidity risk. Tokenised RWA offerings may involve evolving regulatory frameworks. The classification of the token, your rights as a token-holder, tax treatment, and investor protections may differ depending on your jurisdiction. Please read all pool documentation carefully and consider seeking independent advice.